PA DoR REV-1220 AS 2007 free printable template

Show details

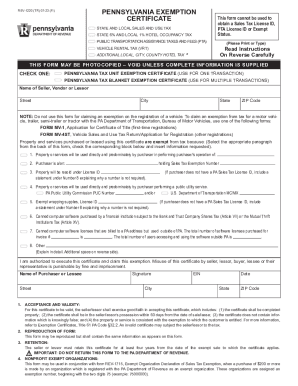

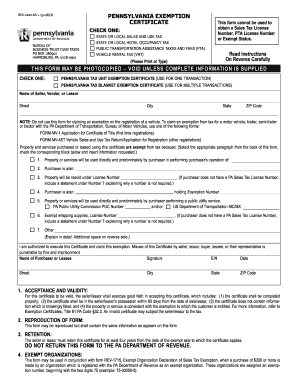

REV-1220 AS 1-07 START COMMONWEALTH OF PENNSYLVANIA DEPARTMENT OF REVENUE BUREAU OF BUSINESS TRUST FUND TAXES PO BOX 280901 HARRISBURG PA 17128-0901 PENNSYLVANIA EXEMPTION CERTIFICATE CHECK ONE STATE OR LOCAL SALES AND USE TAX STATE OR LOCAL HOTEL OCCUPANCY TAX PUBLIC TRANSPORTATION ASSISTANCE TAXES AND FEES PTA VEHICLE RENTAL TAX VRT This form cannot be used to obtain a Sales Tax License Number PTA License Number or Exempt Status.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA DoR REV-1220 AS

Edit your PA DoR REV-1220 AS form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA DoR REV-1220 AS form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PA DoR REV-1220 AS online

Follow the guidelines below to benefit from a competent PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit PA DoR REV-1220 AS. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA DoR REV-1220 AS Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA DoR REV-1220 AS

How to fill out PA DoR REV-1220 AS

01

Obtain the PA DoR REV-1220 AS form from the Pennsylvania Department of Revenue website.

02

Fill in your personal information at the top of the form, including your name, address, and Social Security Number.

03

Provide the details of your income sources, including wages, self-employment income, and any other taxable income.

04

Complete the sections related to deductions, credits, and any other adjustments to your income.

05

Review the tax tables provided in the form to calculate your tax liability based on your reported income.

06

Sign and date the form at the bottom, affirming that the information provided is correct.

07

Submit the completed form to the Pennsylvania Department of Revenue using the specified submission method.

Who needs PA DoR REV-1220 AS?

01

Individuals or businesses that need to report income, claim deductions, or pay taxes in Pennsylvania are required to fill out PA DoR REV-1220 AS.

Fill

form

: Try Risk Free

What is form pa rev 1220?

When should I use a REV-1220 PA Exemption Certificate? Exemption certificates are required to substantiate all tax exempt sales, except vehicles. The purchaser gives the completed form to the seller when claiming an exemption on Sales Tax.

People Also Ask about

How to fill out Pennsylvania exemption certificate?

How to fill out a Pennsylvania Exemption Certificate Enter your Sales Tax Account ID on Line 3. Name of purchaser should be your registered business name. Address of purchaser should be the registered address of your company. Sign, enter your EIN and date the form.

What is rev-1220 used for?

When should I use a REV-1220 PA Exemption Certificate? Exemption certificates are required to substantiate all tax exempt sales, except vehicles. The purchaser gives the completed form to the seller when claiming an exemption on Sales Tax.

How long is a PA sales tax exemption certificate good for?

For example, Pennsylvania regulations state that sales tax exemption certificates “should” be renewed every four years.

What is a rev 1220?

1. Revised 9/8/2022. Purpose: Use this guide to properly completing the PA Exemption Certificate (REV-1220). NOTE: This. form may be used in conjunction with your sales tax/wholesaler license to claim exemptions from sales tax for the purpose of resale.

What are exemptions for PA tax?

Some types of income are exempt from Pennsylvania state income tax, including child support, alimony, unemployment payments, and some capital gains on the sale of a primary residence. Some deductions are allowed for contributions to educational savings accounts and medical or health savings accounts.

How to get rev 1220?

HOW TO GET A RESALE CERTIFICATE IN PENNSYLVANIA ✔ STEP 1 : Complete a PA-100 Form (sales tax registration) ✔ STEP 2 : Fill out the Pennsylvania REV-1220 exemption certificate form. ✔ STEP 3 : Present a copy of this certificate to suppliers when you wish to purchase items for resale.

What items are exempt from PA sales tax?

Sales Tax Exemptions in Pennsylvania Some examples of items which the state exempts from tax charges are certain medical prescriptions, some items used in the agricultural industry, cable television services, meals or foodstuff used in furnishing meals for school children, and newsprint paper.

How to fill out a PA tax exempt form?

How to fill out a Pennsylvania Exemption Certificate Enter your Sales Tax Account ID on Line 3. Name of purchaser should be your registered business name. Address of purchaser should be the registered address of your company. Sign, enter your EIN and date the form.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my PA DoR REV-1220 AS in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your PA DoR REV-1220 AS and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out PA DoR REV-1220 AS using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign PA DoR REV-1220 AS and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I fill out PA DoR REV-1220 AS on an Android device?

Complete PA DoR REV-1220 AS and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is PA DoR REV-1220 AS?

PA DoR REV-1220 AS is a tax form used in Pennsylvania to report income for certain businesses and individuals for the purpose of state income tax calculations.

Who is required to file PA DoR REV-1220 AS?

Businesses and individuals that have income subject to Pennsylvania state tax must file the PA DoR REV-1220 AS form.

How to fill out PA DoR REV-1220 AS?

To fill out PA DoR REV-1220 AS, you need to provide your identification information, report your income, claim any deductions or credits, and sign the form before submitting it to the Pennsylvania Department of Revenue.

What is the purpose of PA DoR REV-1220 AS?

The purpose of PA DoR REV-1220 AS is to provide the Pennsylvania Department of Revenue with information necessary for assessing and collecting state income tax.

What information must be reported on PA DoR REV-1220 AS?

The PA DoR REV-1220 AS requires reporting of personal identification details, sources of income, applicable deductions, any tax credits, and other relevant financial information.

Fill out your PA DoR REV-1220 AS online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA DoR REV-1220 AS is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.