PA DoR REV-1220 AS 2007 free printable template

Show details

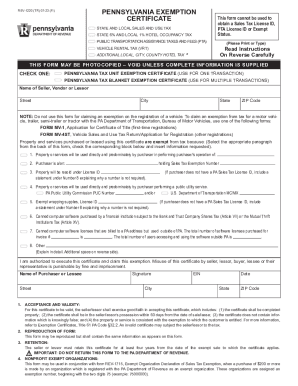

REV-1220 AS 1-07 START COMMONWEALTH OF PENNSYLVANIA DEPARTMENT OF REVENUE BUREAU OF BUSINESS TRUST FUND TAXES PO BOX 280901 HARRISBURG PA 17128-0901 PENNSYLVANIA EXEMPTION CERTIFICATE CHECK ONE STATE OR LOCAL SALES AND USE TAX STATE OR LOCAL HOTEL OCCUPANCY TAX PUBLIC TRANSPORTATION ASSISTANCE TAXES AND FEES PTA VEHICLE RENTAL TAX VRT This form cannot be used to obtain a Sales Tax License Number PTA License Number or Exempt Status.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your rev 1220 as 1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rev 1220 as 1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rev 1220 as 1 07 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit amazon form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

PA DoR REV-1220 AS Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out rev 1220 as 1

To fill out rev 1220 as 1, follow the following steps:

01

Begin by gathering all the necessary information required to fill out the form accurately.

02

Start by providing your personal details, such as your full name, address, and contact information, in the designated fields.

03

Proceed to the section where you need to specify the purpose of filling out rev 1220 as 1. Clearly state the reason for needing this particular revision.

04

Fill out any additional sections or fields required by the form, ensuring that all the information provided is correct and up-to-date.

05

Carefully review the entire form before submitting it, making sure there are no errors or missing information.

06

Once you are satisfied that the form is complete and accurate, sign and date it as necessary.

6.1

Rev 1220 as 1 may be needed by individuals or organizations who have specific reasons or situations that require this particular revision. Some examples include:

07

Tax professionals who need to update their records with the latest version of this form for client documentation.

08

Employers who are required to submit documentation related to employee payroll or tax information.

09

Individuals who need to report certain financial transactions or deductions accurately for legal or tax purposes.

10

Government agencies or regulatory bodies that use rev 1220 as 1 for data collection or compliance purposes.

Remember, the specific need for rev 1220 as 1 will vary depending on the individual or organization's circumstances. It is essential to consult the relevant guidelines or seek professional advice when filling out this form to ensure compliance and accuracy.

Fill form : Try Risk Free

What is form pa rev 1220?

When should I use a REV-1220 PA Exemption Certificate? Exemption certificates are required to substantiate all tax exempt sales, except vehicles. The purchaser gives the completed form to the seller when claiming an exemption on Sales Tax.

People Also Ask about rev 1220 as 1 07

How to fill out Pennsylvania exemption certificate?

What is rev-1220 used for?

How long is a PA sales tax exemption certificate good for?

What is a rev 1220?

What are exemptions for PA tax?

How to get rev 1220?

What items are exempt from PA sales tax?

How to fill out a PA tax exempt form?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is rev 1220 as 1?

To convert "rev 1220" to the number 1, we need additional context or information as "rev" typically refers to a revision or version number and does not have a direct connection to the number 1.

Who is required to file rev 1220 as 1?

Rev 1220 is a form used for electronic filing of information returns, specifically the 1099 series. Therefore, any individual or business that is required to file information returns, such as 1099-MISC or 1099-NEC, would typically need to file the Rev 1220 as 1.

How to fill out rev 1220 as 1?

Form 1220 refers to the Annual Report of Reportable Transactions. To fill out this form as a single individual, follow these steps:

1. Obtain the form: Download Form 1220 from the Internal Revenue Service (IRS) website or request a physical copy if necessary.

2. Provide your personal information: Enter your name, Social Security Number (SSN), address, and other requested personal details at the top of the form.

3. Select the relevant type of reportable transaction: Identify the type of reportable transaction you are reporting by checking the appropriate box in Part I of the form. Reportable transactions can include certain tax shelter transactions, listed and confidential transactions, and other types of transactions where additional disclosure is required.

4. Calculate the transaction amount: Enter the amount of the transaction in question in Part II of the form. Note that this amount should be reported in U.S. dollars. Consult the instructions accompanying the form for specifics on how to calculate the transaction amount for each type of reportable transaction.

5. Provide additional details: In Part III of the form, you may need to provide additional information or attachments related to the specific type of reportable transaction. Review the instructions to determine any requirements for providing documentation or descriptions of the transaction.

6. Sign and date the form: Sign and date the bottom of the form to certify that the information provided is accurate and complete.

7. Retain a copy: Make a copy of the completed form for your own records before submitting it to the IRS.

8. Submit the form: Mail the completed and signed Form 1220 to the address specified in the instructions. Ensure that you use the correct mailing address, as it may vary depending on your location.

Note: If you are uncertain or have specific questions about how to fill out this form, it is recommended to consult a tax professional or seek guidance from the IRS.

What is the purpose of rev 1220 as 1?

Without more information or context, it is not possible to determine the purpose of "rev 1220 as 1." The term "rev" could refer to a revision or version number, while "1220" could potentially indicate a specific release or update. However, the meaning of "as 1" is unclear without additional information.

When is the deadline to file rev 1220 as 1 in 2023?

Unfortunately, the given information "rev 1220" is insufficient to determine the specific deadline for filing it as 1 in 2023. Could you please provide more context or elaborate on the nature of rev 1220?

What is the penalty for the late filing of rev 1220 as 1?

The penalty for the late filing of Form REV-1220 in Pennsylvania can vary depending on certain factors such as the amount of tax due, the length of the delay, and whether the late filing was intentional or unintentional.

Generally, if the late filing is unintentional, the penalty is calculated at the rate of 5% per month, up to a maximum of 25% of the unpaid tax. However, if the late filing is intentional, the penalty increases to 20% per month, up to a maximum of 100% of the unpaid tax. Additionally, interest will also be charged on the unpaid tax amount.

It is important to note that these penalties and interest rates may be subject to change, and it is advisable to consult the official Pennsylvania Department of Revenue or a tax professional for the most up-to-date information regarding penalties for late filing.

Can I create an electronic signature for signing my rev 1220 as 1 07 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your amazon form and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out rev 1220 as 1 07 using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign amazon form and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I fill out rev 1220 as 1 07 on an Android device?

Complete amazon form and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your rev 1220 as 1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.